8 Simple Techniques For Property By Helander Llc

8 Simple Techniques For Property By Helander Llc

Blog Article

10 Simple Techniques For Property By Helander Llc

Table of ContentsExamine This Report on Property By Helander LlcGetting The Property By Helander Llc To WorkAn Unbiased View of Property By Helander LlcThe Ultimate Guide To Property By Helander LlcProperty By Helander Llc Things To Know Before You BuyThe Greatest Guide To Property By Helander Llc

The advantages of spending in real estate are various. Right here's what you need to know concerning genuine estate benefits and why real estate is considered a great financial investment.The benefits of investing in real estate include easy revenue, stable cash money flow, tax advantages, diversity, and leverage. Real estate investment trusts (REITs) provide a method to spend in actual estate without having to possess, operate, or financing residential or commercial properties.

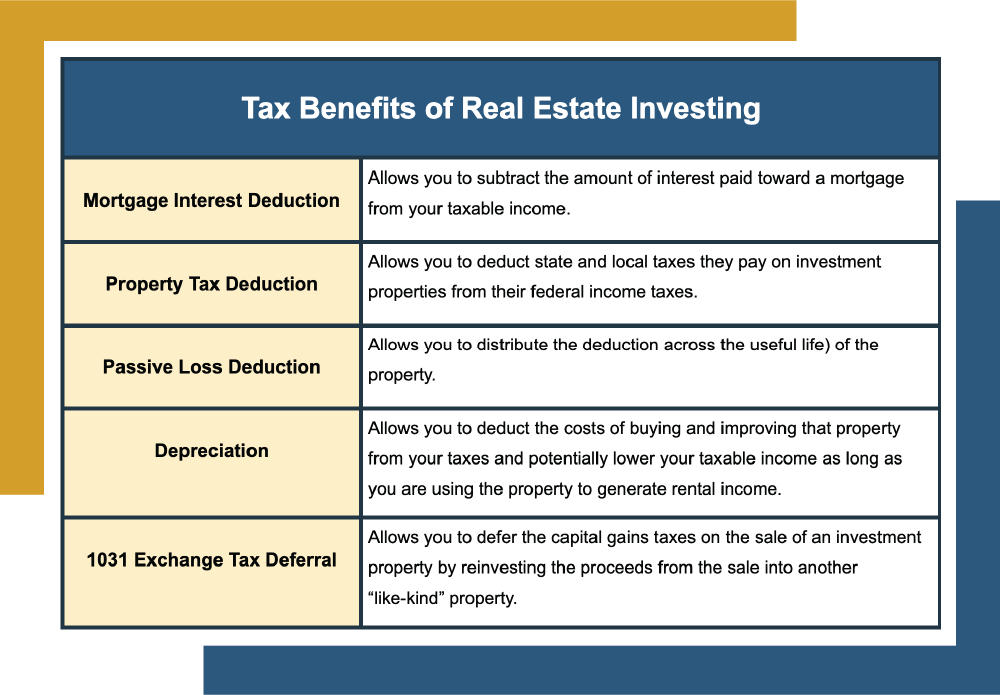

In a lot of cases, capital only enhances in time as you pay for your mortgageand develop your equity. Actual estate investors can benefit from many tax obligation breaks and reductions that can conserve cash at tax time. Generally, you can subtract the reasonable prices of owning, operating, and handling a residential or commercial property.

The Greatest Guide To Property By Helander Llc

Genuine estate worths tend to raise over time, and with an excellent investment, you can transform a profit when it's time to sell. As you pay down a home home mortgage, you develop equityan property that's component of your web well worth. And as you build equity, you have the utilize to get more residential properties and increase cash flow and riches also more.

Because real estate is a concrete possession and one that can work as security, financing is easily available. Property returns differ, depending upon elements such as place, possession class, and administration. Still, a number that numerous investors go for is to defeat the average returns of the S&P 500what many individuals describe when they say, "the market." The inflation hedging ability of property comes from the positive relationship between GDP development and the demand for real estate.

Getting My Property By Helander Llc To Work

This, consequently, equates right into greater funding worths. For that reason, realty has a tendency to keep the purchasing power of resources by passing several of the inflationary pressure on occupants and by integrating several of the inflationary pressure in the form of funding appreciation. Home loan loaning discrimination is unlawful. If you believe you have actually been discriminated versus based upon race, religious beliefs, sex, marital condition, usage of public assistance, national origin, impairment, or age, there are actions you can take.

Indirect realty spending includes no direct possession of a home or homes. Rather, you purchase a swimming pool along with others, whereby a management firm has and runs buildings, otherwise possesses a profile of mortgages. There are numerous ways that possessing realty can safeguard against rising cost of living. Residential property worths may increase higher than the price of inflation, leading to resources gains.

Buildings funded with a fixed-rate loan will certainly see the loved one amount of the monthly mortgage settlements drop over time-- for instance $1,000 a month as a fixed settlement will come to be much less challenging as inflation wears down the purchasing power of that $1,000. https://justpaste.it/dgy0k. Often, a key house is not considered to be a property investment considering that it is utilized as one's home

The Main Principles Of Property By Helander Llc

Despite having the assistance of a broker, it can take a few weeks of job simply to find the best counterparty. Still, realty is a distinct asset course that's easy to comprehend and can improve the risk-and-return profile of a financier's portfolio. On its very own, property offers cash flow, tax breaks, equity structure, competitive risk-adjusted returns, and a realtors sandpoint idaho hedge versus rising cost of living.

Buying realty can be an incredibly rewarding and financially rewarding venture, but if you resemble a lot of new capitalists, you may be wondering WHY you need to be purchasing realty and what benefits it brings over various other financial investment opportunities. In enhancement to all the remarkable advantages that come along with investing in real estate, there are some disadvantages you require to take into consideration.

Getting The Property By Helander Llc To Work

If you're looking for a method to get right into the realty market without needing to invest numerous countless bucks, have a look at our residential or commercial properties. At BuyProperly, we make use of a fractional possession version that permits investors to start with as low as $2500. One more major advantage of realty investing is the ability to make a high return from buying, renovating, and reselling (a.k.a.

All about Property By Helander Llc

If you are charging $2,000 lease per month and you incurred $1,500 in tax-deductible expenses per month, you will just be paying tax obligation on that $500 earnings per month (Sandpoint Idaho real estate). That's a big difference from paying tax obligations on $2,000 per month. The revenue that you make on your rental unit for the year is thought about rental income and will certainly be exhausted as necessary

Report this page